The cannabis industry has been trending lower since the election with market sentiment in negative territory following the appointment of Alabama Senator Jeff Sessions as United States Attorney General.

The recent pullback has been associated with weaker-than-average trading volume and we are monitoring this trend on an industry-wide and a company-by-company basis. The lighter trading volume has had a significant affect on cannabis stocks as the average stock spread has expanded (difference between a stock’s buy and sell price) and we continue to monitor this trend closely.

Although there are several trends in the cannabis industry that leave us concerned with many publicly traded companies, we remain cautiously optimistic on specific sectors of the industry, in particular biotech and Canadian licensed medical cannabis producers.

We want to highlight some recent industry developments to provide an update on how companies are operating post-election.

Lexaria Continues to Execute After its U.S. Patent Issuance

Today, Lexaria Bioscience (LXRP) announced a letter of intent for the licensing of its proprietary absorption and palatability enhancing technology to Hempco Food and Fiber Inc. (HEMP: TSX Venture).

Hempco is a trusted and respected pioneer, innovator and provider of premier hemp seed foods for more than 15 years. The company has customers all over North America, Europe and Asia. Hempco is vertically integrated from field to consumer products and has rapidly growing international sales and distribution that offer synergy opportunities with Lexaria’s existing hemp-oil based product.

Today’s development comes one month after Lexaria was issued U.S. Patent No. 9,474,725- Cannabinoid Infused Food and Beverage Compositions and Methods of Use Thereof. The patent pertains to the company’s method of improving bioavailability and the taste of certain cannabinoid lipophilic active agents in food products.

This patent was Lexaria’s first patent granted or awarded by the USPTO. The patent protects the company’s intellectual property as it relates to the infusion of cannabinoid compounds in edible products, the primary focus of Lexaria’s business.

Prior to today’s announcement, Lexaria had completed two definitive agreements and entered two letters of intent for the out-licensing of its technology. Today’s announcement is a testament to the significance of the patent issuance as it clearly strengthens Lexaria’s position in potential deals and accelerates the potential for additional future technology out-licensing agreements.

We are very favorable on today’s announcement and think LXRP is a stock that investors should have on their watch list. The company has continued to execute and 2016 has been a banner year for Lexaria as the company has been able to achieve several significant milestones.

Canopy Growth Goes Global

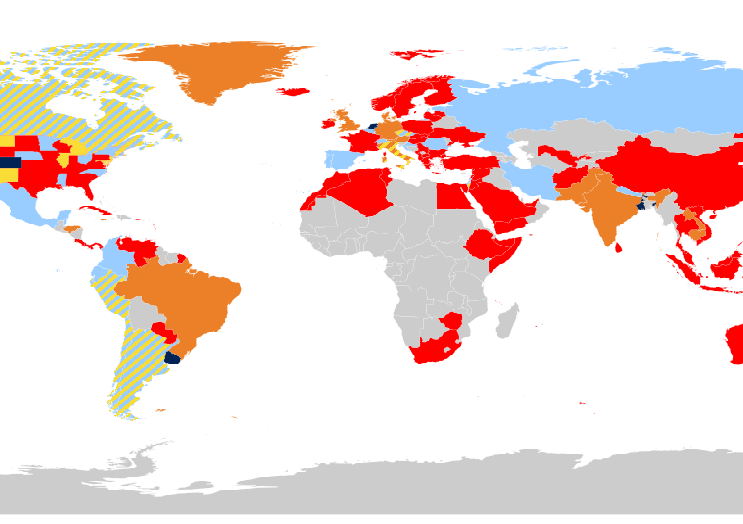

Yesterday, Canopy Growth Corp (TWMJF) (CGC.TO) reported an agreement to acquire MedCann GmbH Pharma and Nutraceuticals, a German-based pharmaceutical distributor that has placed Tweed-branded cannabis strains in German pharmacies. MedCann is federally licensed by the German Health Ministry to import, manufacture and distribute medical cannabis products.

Although Germany began to permit patient access to medical cannabis in 2005, domestic production does not currently exist. The country relies solely on imported products. For that reason, MedCann is an attractive acquisition candidate given its ability to navigate Germany’s complex regulatory environment for importing and distributing cannabis.

Canopy’s various production sites have a track record of producing consistent strains that yield reliable cannabinoid profiles harvest after harvest. This was an important aspect of the due diligence process as such consistency is a federal requirement for cannabis exports entering Germany.

Canopy Growth Corporation is the only publicly traded licensed Canadian medical cannabis producer on the TSX exchange (other LPs are on the TSX Venture Exchange) and we believe that the company is one of the best long-term cannabis investment opportunities.

Canopy Growth recently reported impressive financial and operating results for its second quarter. During the quarter, the total number of registered patients increased by 47% to over 24,400.

Avoid United Cannabis Corp like the Plague

We continue to urge caution with shares of United Cannabis Corp (CNAB) as the stock has rallied more than 640% since September 1st.

During this time, the company’s Chief Executive Officer/President, its Chief Operating Officer, and its Vice President have continued to dump stock and this trend has shown no signs of slowing down.

So far in November, senior management has sold more than 150,000 shares, an improvement when compared to October where man

Get the Latest Cannabis News & Stock Picks.

Get the Latest Cannabis News & Stock Picks.

Comments