TORONTO, Nov. 30, 2022 /CNW/ – Khiron Life Sciences Corp. (“Khiron” or the “Corporation“) (TSXV: KHRN) (OTCQX: KHRNF) (Frankfurt: A2JMZC), a global leader in medical cannabis throughout Latin America and Europe, announced today its financial results for the quarter ended September 30, 2022, which were prepared in accordance with International Financial Reporting Standards (“IFRS“). Third quarter 2021 comparable numbers were also prepared in accordance with IFRS. All financial results for the third quarter ended September 30, 2022, and related comparisons to prior periods included in this press release have not been reviewed by the auditors of the Corporation. These filings are available for review on the Corporation’s SEDAR profile at www.sedar.com. All financial information in this press release is reported in Canadian dollars, unless otherwise indicated.

Summary of Key Financial Results:

3 Months Ended | 3 Months Ended | 3 Months Ended | |

Canadian dollars (‘000s) | |||

$ | $ | $ | |

Revenues | 3,385 | 3,519 | 4,473 |

Medical Cannabis | 1,604 | 1,207 | 2,607 |

Gross profit before fair value adjustments | 1,381 | 1,693 | 2,246 |

Gross profit from Medical Cannabis before FV | 1,081 | 1,078 | 1,993 |

General and administrative costs | 4,403 | 5,182 | 3,799 |

Net loss | (3,576) | (3,337) | (2,171) |

Adjusted EBITDA (1) | (2,831) | (3,772) | (2,288) |

Net loss per share (basic and diluted) | (0.02) | (0.02) | (0.01) |

Weighted average shares outstanding | 214,528 | 177,028 | 186,444 |

(1) | Adjusted EBITDA (earnings before interest, taxes, depreciation and amortization or in this case loss) and Gross Profit do not have a standardized meaning prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other issuers. The Corporation calculates Adjusted EBITDA as net loss before tax as reported under IFRS and adding back share-based compensation expenses, transaction fees, unrealized gain on changes in fair value of biological assets, interest, depreciation, amortization, impairments, unrealized gain or loss in warrants and non-recurring items. The Corporation calculates Gross Profit as revenue less cost of revenue, changes in fair value of inventory sold, and unrealized gain (loss) on changes in fair value of biological assets. Please refer to the section entitled “Non-IFRS Financial Measures” in this press release. |

Q3 2022 operating highlights and subsequent events:

- Adjusted EBITDA loss of $2.8 million, a reduction of 25% year-over-year, driven by a decrease of 17% year-over-year in expenses during Q3 2022, and the Corporation´s high gross margins across its medical cannabis segment of 67%.

- Overall revenues for Q3 2022 decreased 24% driven primarily by a reduction of medical cannabis sales in Colombia, due to an interruption in insurance-covered prescriptions for Colombian patients during the new change of Government, which began its new period August 7th, 2022. The new incoming Government is reviewing the protocols for use of medical cannabis for specific conditions for which there is much evidence of medical cannabis use, to create a more robust financing framework under Colombia´s universal health benefits system.

- In Europe, revenues increased by 141% year-over-year, driven by revenues in the United Kingdom, where the Corporation is now increasing its existing product portfolio. In Germany, the restart of Khiron medical cannabis product sales was delayed because of import product approvals to Pharmadrug GmbH (“Pharmadrug“) for Khiron’s existing and new product portfolio, which have now been obtained. The Pharmadrug acquisition enables Khiron to sell directly to pharmacies in Germany without the need for a third-party distribution partner. As a result of the Pharmadrug acquisition, the Corporation was able to successfully export to and sell its first two medical cannabis SKUs in Switzerland. The acquisition formally closed on August 2nd, 2022, after the clearance certificate required under German Foreign Trade Regulation was obtained. Since obtaining import approvals from German regulators, Khiron is now selling a total of seven medical cannabis SKUs and further SKUs are already registered and will be launched over the next weeks.

- In October 2022, Khiron began sales of its first THC-dominant, Khiron-branded products into Brazil, making it one of the first companies to sell approved THC medications into the country. The Company opened its first ZereniaTM clinic in Rio de Janeiro and it is in full operation.

- As of September 30, 2022, the Corporation´s cash used in operating activities was $9.8 million, compared to -$15.2 million in the nine months ended September 30, 2021, resulting in a net cash of $1.9 million at the end of Q3 2022. The Corporation continues to actively manage its working capital cycle, while reducing overall general and administrative costs.

- In November 2022, the Corporation was approved a loan with one of Colombia´s most traditional bank lenders for an initial amount of approximately $700,000, which will be used to fund working capital requirements in its Zerenia™ clinical operations in Colombia. This would mark the first time that a privately-owned, traditional banking entity lends funds to a medical cannabis-related business in Colombia. In addition, the Corporation continues to evaluate options for capitalizing the growth of its business.

Management commentary:

Alvaro Torres, Khiron CEO and Director, comments, “This quarter presented transitional challenges in Colombia and Germany, impacting top line sales and our short-term goals on profitability. In Colombia, insurance coverage has always been a priority for the Company, and as we have witnessed in the past year and a half, it’s an importance in serving patients from all communities. The new Government has been very supportive of the industry and the efforts of companies such as Khiron to ensure access to medical cannabis. We want to thank our patient base, who was instrumental in advocating for the need of insurance coverage, and the Government of Colombia who will create a more robust long-term framework, so that medical cannabis continues reach patients who depend on our services. In Germany, we are pleased to have finished all regulatory approvals for the acquisition of Pharmadrug as well as obtaining import permits for our product portfolio. This has allowed us, in Q4 2022, to increase our presence in this country and to look at different growth opportunities through our Pharmadrug distribution platform, such as our new exports into Switzerland. Meanwhile, we continue to reduce expenses, while growing our high gross margin medical cannabis business in Europe and the rest of Latin America. The Company continues to evaluate all strategic opportunities and financing options.”

Webcast Details:

Khiron invites individual and institutional investors, as well as advisors and analysts, to attend the Corporation’s Third Quarter 2022 Conference Call, followed by a Q&A session.

DATE: Wednesday, November 30, 2022

TIME: 11:00am ET

PRESENTERS: Alvaro Torres, Khiron Chief Executive Officer and Director, Helen Bellwood, Khiron Chief Financial Officer, and Franziska Katterbach, President of Khiron Europe.

FORMAT: Live 45-minute presentation & Q&A session

REGISTER LINK: https://us06web.zoom.us/webinar/register/WN_nB0mQsxmR2SgKJCnHlhL9Q

Grant of Restricted Share Units

On November 23, 2022, the Board of Directors approved the grant of 87,500 restricted share units (“RSUs”) to an officer of the Corporation, upon the satisfaction of certain milestones associated with the grant. The RSUs were subject to performance-based vesting conditions that are already met and will expire on December 15, 2025.

Participant | Position(s) | Equity-Based | Expiry Date |

Juan Diego | VP Corporate Affairs | 87,500 RSUs | 15/12/2025 |

About Khiron Life Sciences Corp.

Khiron is a global medical cannabis company with core operations in Latin America and Europe. Leveraging wholly owned medical health clinics and proprietary telemedicine platforms, Khiron combines a patient-oriented approach, physician education programs, scientific expertise, product innovation, and focus on creating access to drive prescriptions and brand loyalty with patients worldwide. The Company has a sales presence in Colombia, Germany, UK, Peru, Switzerland, and Brazil. The Company is led by Co-founder and Chief Executive Officer, Alvaro Torres, together with an experienced and diverse executive team and Board of Directors.

Visit Khiron online at investors.khiron.ca

Linkedin https://www.linkedin.com/company/khiron-life-sciences-corp/

Non-IFRS Financial Measures

[NTD: Khiron to review and confirm the below disclosure regarding non-IFRS financial measures, which has been taken from the Q2 2022 earnings release. Note that we included “Gross Profit”, as it was previously disclosed as a non-IFRS financial measure in Q2 2022, but please confirm and review and include the disclosure below as necessary for all non-IFRS financial measures included.]

This press release includes references to “Adjusted EBITDA” and “Gross Profit”, which are financial measure that does not have a standardized meaning prescribed by IFRS. Investors are cautioned that non-IFRS financial measures should not be considered in isolation or construed as an alternative to the measurements of performance calculated in accordance with IFRS, because given the non-standardized meaning of non-IFRS financial measures, they may not be comparable to similar measures presented by other issuers.

Adjusted EBITDA

Adjusted EBITDA is calculated as reported under IFRS and adding back share-based compensation expense, transaction fees, unrealized gain on changes in fair value of biological assets, interest, depreciation, amortization, impairments, unrealized gain or loss in warrants, and non-recurring items. Adjusted EBITDA provides an indication of the results generated by the Corporation’s principal business activities prior to how these activities and assets are financed (including mark-to-market movements of the warrant value), depreciated and amortized or how the results are taxed in various jurisdictions, impairment of property, plant, and equipment, impairment of intangible assets, changes in fair value of inventory, unrealized changes in fair value of biological assets, prior to the effect of foreign exchange, other income and expenses, and non-cash share-based payment expense. The term Adjusted EBITDA does not have any standardized meaning and therefore may not be comparable to similar measures presented by other issuers. The Corporation believes Adjusted EBITDA is useful for comparing results from one period to another, as Adjusted EBITDA normalizes earnings to exclude certain non-operating, non-cash, and extraordinary amounts. Existing Adjusted EBITDA is not necessarily predictive of the Corporation’s future performance or the Adjusted EBITDA of the Corporation as at any future date.

The following table provides a reconciliation of net loss to Adjusted EBITDA.

For the three months ending September 30, ($ Cdn thousands) | 2022 | 2021 | |

Net loss | (3,576) | (3,335) | |

Add back (deduct): | |||

Interest expense | 93 | 43 | |

Taxes | 125 | 1 | |

Depreciation and amortization | 556 | 341 | |

Net fair value adjustment on biological assets and cannabis product sales | (272) | (120) | |

Foreign exchange loss | 102 | – | |

Impairment on other items | 88 | – | |

Share-based compensation | 328 | 535 | |

Unrealized gain on warrants | (275) | (1,235) | |

Adjusted EBITDA | (2,831) | (3,771) | |

For the nine months ending June 30, ($ Cdn thousands) | 2022 | 2021 | |

Net loss | (11,159) | (13,627) | |

Add back (deduct): | |||

Interest expense | 281 | 145 | |

Taxes | 84 | (13) | |

Depreciation and amortization | 1,805 | 964 | |

Net fair value adjustment on biological assets and cannabis product sales | 263 | (1,371) | |

Foreign exchange loss | 506 | – | |

Impairment on other items | 85 | – | |

Share-based compensation | 975 | 2,568 | |

Amortization of signing bonus | – | 840 | |

Unrealized gain on warrants | (1,235) | (1,234) | |

(8,395) | (11,728) | ||

Gross Profit

Gross Profit is defined as revenue less cost of revenue, changes in fair value of inventory sold, and unrealized gain (loss) on changes in fair value of biological assets. Management believes that Gross Profit is a useful supplemental measure of operations and is used by management to analyze overall and segmented operating performance. Gross Profit is not intended to represent an alternative to net earnings or other measures of financial performance calculated in accordance with IFRS.

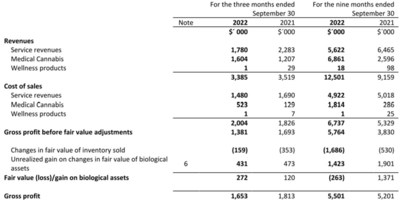

The following table provides a reconciliation of revenues to Gross Profit.

Cautionary Statement Regarding Forward-Looking Statements

This press release may contain “forward-looking information” within the meaning of applicable securities legislation. All information contained herein that is not historical in nature constitutes forward-looking information. Forward-looking information contained in this news release include, without limitation, statements pertaining to the Corporation’s business plans and goals, including its goal of achieving profitability in the near future, and improving revenue collections, reducing cash outflows, and leveraging the Corporation’s assets to generate more working capital. Forward-looking information and statements contained in this news release reflect management’s current beliefs and is based on information currently available and on assumptions that management believes to be reasonable. These assumptions include, but are not limited to, assumptions regarding the future regulatory developments and economic conditions, and the Corporation’s ability to continue its growth and reduce costs.

Although management believes that its expectations and assumptions to be reasonable, forward-looking information is always subject to known and unknown risks, uncertainties, and other factors, many of which are beyond the control of management, that may cause actual results to differ materially from those expressed or implied in such forward-looking information. Such risks and uncertainties include but are not limited to the following: risks relating to general economic conditions and capital markets; risks relating to the availability of financing on satisfactory terms; risks relating to the COVID-19 pandemic or other health crises; risks relating to regulatory, legislative, competitive and political conditions; business integration risks; as well as those other risk factors discussed in Khiron’s most recent annual information form which is available on Khiron’s SEDAR profile at www.sedar.com.

As a result of the foregoing and other risks and uncertainties, readers are cautioned not to place undue reliance on forward-looking information contained in this press release. Readers are further cautioned that the foregoing risks and uncertainties is not exhaustive, and there may be other risks and uncertainties, presently unknown to management of the Corporation, that may cause actual results to differ materially from those expressed or implied in forward-looking statements contained in this press release. The forward-looking information contained in this press release is expressly qualified by this cautionary statement. Khiron disclaims any intention to update or revise any forward-looking information disclosed herein, whether as a result of new information, future events or otherwise, except as required by law.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/khiron-life-sciences-reports-third-quarter-2022-financial-results-301690188.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/khiron-life-sciences-reports-third-quarter-2022-financial-results-301690188.html

SOURCE Khiron Life Sciences Corp.

Get the Latest Cannabis News & Stock Picks.

Get the Latest Cannabis News & Stock Picks.

Comments