VANCOUVER, British Columbia, Aug. 22, 2023 (GLOBE NEWSWIRE) — LEEF Brands, Inc. (“LEEF” or the “Company”) (CSE: LEEF, OTC: LEEEF) a premier vertical cannabis operator, is pleased to report its financial results for the three and six months ended June 30, 2023. All currency references used herein are in United States dollars unless otherwise noted.

Financial Highlights:

- Net sales of $9.3M for the three months ended June 30, 2023 and $19.0M for the six months ended June 30, 2023, representing an increase in year over year revenue of 14.60% and 22.5% respectively.

- Gross Profit of $2.9M for the three months ended June 30, 2023 and $6.4M for the six months ended June 30, 2023, representing an increase in year over year gross profit of 8.2% and 11.6% respectively.

- Gross Margin of 31.2% for the three months ended June 30, 2023 and 33.1% for the six months ended June 30, 2023.

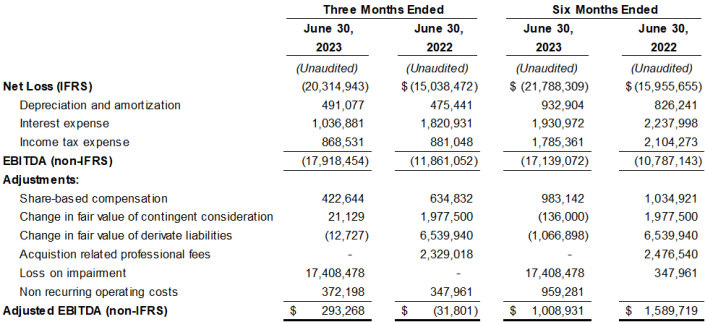

- Adjusted EBITDA of $293.3K for the three months ended June 30, 2023 and $1.0M for the six months ended June 30, 2023.

Management Commentary:

“Despite the continued difficult environment in the California cannabis industry, I am extremely pleased to report strong financial performance for the first six months of 2023. Our continued success is a result of the implementation of our corporate strategy that is focused on our core competencies, our team’s relentless dedication to achieving our corporate objectives and an unwavering commitment to our customers,” stated Micah Anderson, CEO of LEEF. “As we continue to navigate the challenges of the market, we remain focused on advancing our strategic priorities in an effort to continue to drive long-term shareholder value. As part of this, we are extremely excited to be progressing towards closing the $7.0 million financing related to the sale of the Company’s 60% interest in its cultivation and real estate assets in Santa Barbara, California, of which the proceeds will be principally used to develop one of the largest biomass cultivation sites in the state. By bringing supply of biomass material in-house, LEEF Labs can focus its efforts on its goal to produce the best and most consistent concentrates at scale. We expect this initiative will enable the Company to enhance efficiencies across the entire manufacturing process, foster stronger relationships with its client-base by providing exclusive genetics, higher-yielding strains and unique terpene profiles, and will also support LEEF Labs customers’ growth with a predictable and consistent supply of the highest quality input material.”

CFO Kevin Wilson added, “We are very pleased to report continued revenue growth, high gross margins and most importantly, positive adjusted EBITDA. Our financial performance is the result of our continued focus on operational excellence and substantial cost cutting measures. Overall, the Company has increased revenues by 23% year over year and we remained laser focused on continuing to generate positive cashflow from operations, which we have now achieved for two straight quarters. In the course of our regular balance sheet review, we have identified the need to record a non-cash goodwill impairment of $17.4 million pertaining to the acquisition of LEEF Holdings Inc. during the quarter. We believe the impairment is reflective of the current challenges in the California cannabis market that we continue to navigate.”

Q2 2023 Financial Results Discussion:

Financial results and analyses will be available on the Company’s investor relations website (https://www.icaninc.com/investors) and SEDAR+ (www.sedarplus.ca).

Subsequent Events to the Three Months Ended June 30, 2023:

The Company is pleased to announce the appointment of Andrew Glashow to the board of directors as an independent director, effective August 4, 2023. Mr. Glashow is a graduate of the University of New Hampshire’s Whittemore School of Business and Economics and has 25 years of experience in capital markets and is seasoned in all phases of business start-up, growth, and development. Mr. Glashow is the Chief Executive Officer of CLS Holdings USA, Inc., a diversified cannabis company in Nevada that consists of two operating businesses, Oasis Cannabis Dispensary and City Trees. Oasis Cannabis Dispensary is a retail cannabis dispensary in Las Vegas, Nevada. City Trees is a cannabis production and manufacturing wholesaler located in North Las Vegas.

The Company is also pleased to announce the appointment of Emily Heitman to the role of Chief Revenue Officer, effective August 4, 2023. Miss. Heitman has been with the organization since inception and has until recently been the Chief Operating Officer for the Company.

The Company also announces the issuance of 2,186,602 common shares at a price per share equal to $0.0666 in respect of the acquisition of The Leaf at 73740 LLC, a premium California retailer located in the heart of Palm Desert, California, previously announced on September 19, 2022. The Company expects to issue an additional 18,580,301 common shares in connection with the acquisition of The Leaf at 73740, LLC as per the press release dated January 12, 2023.

Unaudited Q2 2023 Financial and Operational Metrics

Adjusted EBITDA

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/7701d31e-d421-49e1-8728-9206dc92c406

NON-IFRS FINANCIAL PERFORMANCE MEASURES

The Company has included certain terms or performance measures that are not defined under IFRS in this document, including EBITDA and adjusted EBITDA. Non-IFRS financial performance measures do not have any standardized meaning prescribed under IFRS, and therefore, they may not be comparable to similar measures employed by other companies. The data presented is intended to provide additional information and should not be considered in isolation or as a substitute for measures prepared in accordance with IFRS and should be read in conjunction with the Company’s financial statements

About LEEF Brands Inc. (formerly, Icanic Brands Company Inc.)

LEEF Brands Inc. is a leading California based extraction and manufacturing cannabis company. LEEF is owned and managed by some of the best legacy operators in the industry and is one of California’s largest and most sophisticated vertical cannabis companies. The Company’s platform consists of an integrated supply chain, state of the art manufacturing, and a robust bulk concentrate portfolio that powers some of the largest brands in California. For more information, please visit the company’s website at www.LeefBrands.com.

LEEF Brands Inc.

Per: “Kevin Wilson”

Chief Financial Officer

SOURCE LEEF Brands, Inc.

For further information: LEEF Brands, Inc., Micah Anderson, CEO, or Kevin Wilson, CFO, 707-703-4111, ir@leefca.com

Forward Looking Statements

This news release contains certain forward-looking information and forward-looking statements, as defined in applicable securities laws (collectively referred to herein as “forward-looking statements”) including but not limited to: (i) the continued success of the Company’s corporate strategy and proposed initiatives; (ii) the closing of the Company’s financing related to the sale of its 60% interest in its cultivation and real estate assets in Santa Barbara, California; (iii) the proposed used of proceeds from the completion of the proposed financing; (iv) the Company’s ability to enhance efficiencies across the entire manufacturing process, foster stronger relationships with its client-base and produce a predictable and consistent supply of input material; and (v) its ability to continue to generate positive cashflow from operations. Forward-looking statements reflect current expectations or beliefs regarding future events or the Company’s future performance or financial results. All statements other than statements of historical fact are forward-looking statements. Often, but not always, forward-looking statements can be identified by the use of words such as “plans”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “continues”, “forecasts”, “projects”, “predicts”, “intends”, “anticipates”, “targets” or “believes”, or variations of, or the negatives of, such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “should”, “might” or “will” be taken, occur or be achieved. All forward-looking statements, including those herein are qualified by this cautionary statement.

Although the Company believes that the expectations expressed in such statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the statements. There are certain factors that could cause actual results to differ materially from those in the forward-looking information, including financial and operational results not proving to be as expected or on the timelines expected; the Company not completing certain proposed acquisition or financing transactions at all, or on the timelines expected; the Company not achieving the synergies expected; and other risks disclosed in the Company’s Annual Information Form and other public filings on SEDAR+ at www.sedarplus.ca. Accordingly, readers should not place undue reliance on forward-looking statements.

For more information on the Company, investors are encouraged to review the Company’s public filings on SEDAR+ at www.sedarplus.ca. The forward-looking statements and financial outlooks contained in this news release speak only as of the date of this news release or as of the date or dates specified in such statements. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.

Get the Latest Cannabis News & Stock Picks.

Get the Latest Cannabis News & Stock Picks.

Comments